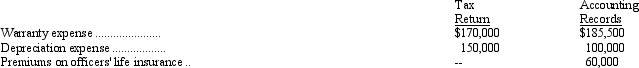

Inventive Corporation's income statement for the year ended December 31, 2011, shows pretax income of $300,000. The following items are treated differently on the tax return and in the accounting records:

Assume that Inventive's tax rate for 2011 is 40 percent. What is the current portion of Inventive's total income tax expense for 2011?

A) $106,200

B) $120,200

C) $130,200

D) $144,200

Correct Answer:

Verified

Q27: On the statement of cash flows using

Q37: Viking Corporation reported depreciation of $250,000 on

Q38: Dodger Corporation reported a loss for both

Q40: On December 31, 2010, Alton, Inc., reported

Q41: Frey Corporation's income statement for the year

Q43: Beta had taxable income of $1,500 during

Q44: For the current year, Santa Fe Company

Q44: Which of the following is an example

Q46: Which of the following represents a permanent

Q47: Gamma had pretax accounting income of $1,400

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents