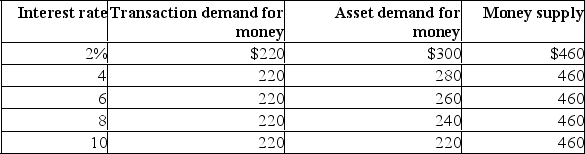

Assume that the desired reserve ratio is 10 percent and there are no excess reserves in the banking system.Also, suppose that the full-employment, non-inflationary level of GDP in this closed, private economy is $1,200.  Refer to the above information.An interest rate of 2 percent is not sustainable because:

Refer to the above information.An interest rate of 2 percent is not sustainable because:

A) the demand for bonds in the bond market will fall and the interest rate will fall.

B) the demand for bonds in the bond market will rise and the interest rate will fall.

C) the supply of bonds in the bond market will decline and the interest rate will rise.

D) the supply of bonds in the bond market will rise and the interest rate will rise.

Correct Answer:

Verified

Q181: All else equal, when the Bank of

Q182: All else equal, when the Bank of

Q185: In terms of the aggregate demand and

Q187: An increase in the money supply will

Q189: The strengths of monetary policy compared to

Q190: In 2004, the Bank of Canada reduced

Q191: A decline in the equilibrium level of

Q194: By early 2008 it became evident that

Q197: A newspaper headline reads: "Bank of Canada

Q199: Which of the following best describes what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents