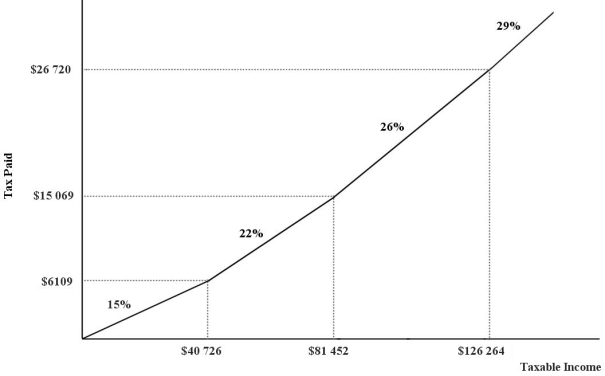

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. An individual with a taxable income of $39 500 will pay in income taxes.

A) $6122

B) $0

C) $8690

D) $5925

E) $6109

Correct Answer:

Verified

Q5: Q59: The Employment Insurance (EI) system operates whereby Q60: Consider a monopolist that is earning profits Q61: Suppose an income tax is levied in Q62: In Canada, public primary and secondary education Q63: The excess burden of a tax![]()

A)

A)

A) increases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents