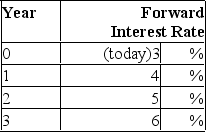

Suppose that all investors expect that interest rates for the 4 years will be as follows:  What is the price of a 2-year maturity bond with a 5% coupon rate paid annually? (Par value = $1,000.)

What is the price of a 2-year maturity bond with a 5% coupon rate paid annually? (Par value = $1,000.)

A) $1,092.97

B) $1,054.24

C) $1,028.51

D) $1,073.34

Correct Answer:

Verified

Q24: The yield curve is a component of

A)the

Q25: The yield curve

A)is a graphical depiction of

Q26: Q27: Forward rates _ future short rates because Q30: Investors can use publicly available financial data Q31: Suppose that all investors expect that interest Q32: Given the yield on a 3-year zero-coupon Q33: The most recently issued Treasury securities are Q34: The on the run yield curve is Q34: ![]()

A)![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents