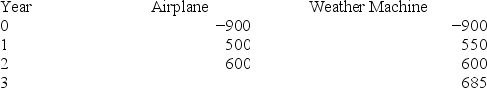

RainMan Inc. is in the business of producing rain upon request. They must decide between two investment projects: a new airplane for seeding rain clouds or a new weather control machine built by Dr. Nutzbaum. The discount rate for the new airplane is 9 percent, while the discount rate for the weather machine is 39 percent (it happens to have higher market risk) . Which investment should the company select and why? (Assume a 0 percent inflation rate and that projected costs do not change over time.)

A) Airplane, because it has a higher NPV

B) Weather machine, because it has a higher NPV

C) Airplane, because it has a higher equivalent annual cash flow

D) Weather machine, because it has a higher equivalent annual cash flow

Correct Answer:

Verified

Q55: A project requires an investment of $900

Q56: Working capital is needed for additional investment

Q57: Which of the following countries allows firms

Q58: When calculating cash flows, one should consider

Q59: Sunk costs are bygones (i.e., they are

Q61: Define the term cash flow for a

Q62: The equivalent annual cash-flow technique is primarily

Q63: What are some of the additional factors

Q64: Briefly explain how inflation is treated consistently

Q65: Most large U.S. corporations keep two separate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents