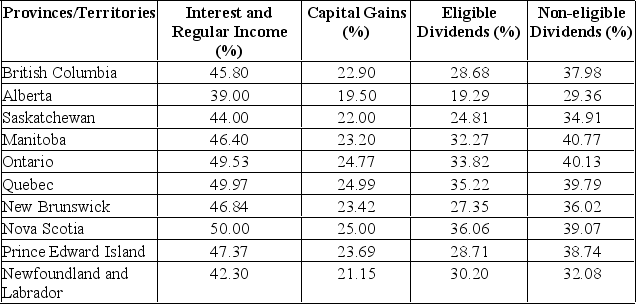

A Manitoba resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid. Combined marginal tax rates for individuals in top provincial tax brackets

A) $17,191

B) $18,191

C) $19,191

D) $20,191

E) $21,191

Correct Answer:

Verified

Q65: If provincial tax rates are 16% on

Q66: Q67: If total assets = $550, fixed assets Q68: An Ontario resident earned $30,000 in Q69: At the beginning of the year, a Q71: A British Columbia resident earned $30,000 Q72: Toby's Pizza has total sales of $987,611 Q73: Amy's Dress Shoppe has sales of $421,000 Q74: Q75: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()