Multiple Choice

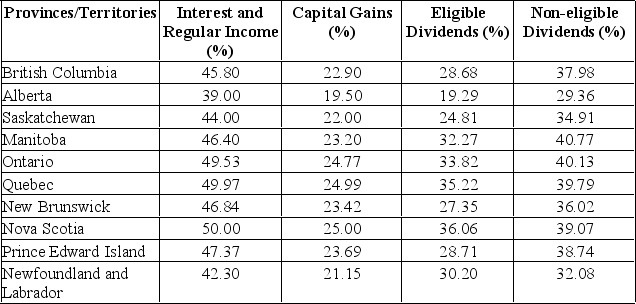

A British Columbia resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the average tax rate.

A) 29.83%

B) 30.44%

C) 31.26%

D) 31.86%

E) 32.23%

Correct Answer:

Verified

Related Questions