Multiple Choice

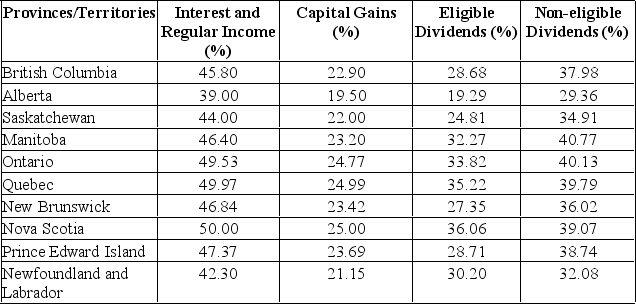

An Ontario resident earned $40,000 in interest income and $60,000 in eligible dividends. Calculate the average tax rate.

A) 43.10%

B) 42.10%

C) 41.10%

D) 40.10%

E) 39.10%

Correct Answer:

Verified

Related Questions

Q203: A British Columbia resident earned $40,000

Q204: Q205: A Manitoba resident earned $40,000 in Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()