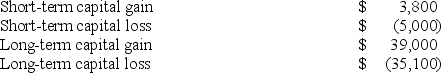

Tom Johnson,whose marginal tax rate on ordinary income is 22%,sold four investment assets resulting in the following capital gains and losses.  How much of Tom's net capital gain is taxed at 15%?

How much of Tom's net capital gain is taxed at 15%?

A) $42,800

B) $3,900

C) $2,700

D) $0

Correct Answer:

Verified

Q41: A beneficiary's basis of inherited property equals

Q56: Three years ago, Mr. Lewis paid $40,000

Q56: At the beginning of the year,Calvin paid

Q57: Which of the following statements about investment

Q59: Sixteen years ago,Ms.Herbert purchased an annuity for

Q66: This year,Ms.Kwan recognized a $16,900 net long-term

Q68: In 1996, Mr. Exton, a single taxpayer,

Q72: Which of the following statements about Section

Q75: Which of the following statements about the

Q78: Ms. Lopez paid $7,260 interest on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents