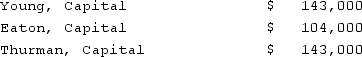

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net loss for the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net loss for the first year?

A) $3,900 loss.

B) $11,700 loss.

C) $10,400 loss.

D) $24,700 loss.

E) $9,100 loss.

Correct Answer:

Verified

Q22: A partnership began its first year of

Q23: Which of the following is not a

Q24: A partnership began its first year of

Q25: A partnership began its first year of

Q26: Which of the following type of organization

Q28: A partnership began its first year of

Q29: A partnership began its first year of

Q30: A partnership began its first year of

Q31: Goodman, Pinkman, and White formed a partnership

Q32: Partnerships have alternative legal forms including all

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents