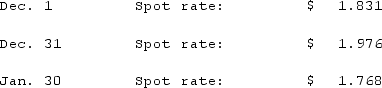

Clark Co., a U.S. corporation, sold inventory on December 1, 2021, with payment of 12,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:  What amount of foreign exchange gain or loss should be recorded on December 31?

What amount of foreign exchange gain or loss should be recorded on December 31?

A) $756 gain.

B) $756 loss.

C) $0.

D) $1,740 loss.

E) $1,740 gain.

Correct Answer:

Verified

Q5: Clark Stone purchases raw material from its

Q6: Clark Co., a U.S. corporation, sold inventory

Q7: A spot rate may be defined as

A)

Q8: Jackson Corp. (a U.S.-based company) sold parts

Q9: Jackson Corp. (a U.S.-based company) sold parts

Q11: The forward rate may be defined as

A)

Q12: Clark Co., a U.S. corporation, sold inventory

Q13: A U.S. company sells merchandise to a

Q14: Clark Stone purchases raw material from its

Q15: On June 1, Cagle Co. received a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents