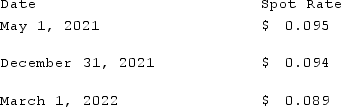

On May 1, 2021, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2022. On May 1, 2021, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2022 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2021. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the impact on Mosby's 2022 net income as a result of this fair value hedge of a firm commitment?

Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the impact on Mosby's 2022 net income as a result of this fair value hedge of a firm commitment?

A) $1,800.00 decrease.

B) $2,500.00 increase.

C) $2,500.00 decrease.

D) $188,760.60 increase.

E) $188,760.60 decrease.

Correct Answer:

Verified

Q51: On October 1, 2021, Eagle Company forecasts

Q52: Williams, Inc., a U.S. company, has a

Q53: Larson Company, a U.S. company, has an

Q54: On December 1, 2021, Joseph Company, a

Q55: Atherton, Inc., a U.S. company, expects to

Q57: Lawrence Company, a U.S. company, ordered parts

Q58: On March 1, 2021, Mattie Company received

Q59: Winston Corp., a U.S. company, had the

Q60: Primo Inc., a U.S. company, ordered parts

Q61: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents