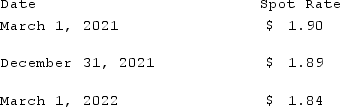

On March 1, 2021, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2022. On March 1, 2021, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2022 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2021. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

A) $0

B) $10,000 increase.

C) $10,000 decrease.

D) $20,000 increase.

E) $20,000 decrease.

Correct Answer:

Verified

Q42: Parker Corp., a U.S. company, had the

Q43: Parker Corp., a U.S. company, had the

Q44: On May 1, 2021, Mosby Company received

Q45: Winston Corp., a U.S. company, had the

Q46: Woolsey Corporation, a U.S. company, expects to

Q48: Woolsey Corporation, a U.S. company, expects to

Q49: On May 1, 2021, Mosby Company received

Q50: On April 1, Quality Corporation, a U.S.

Q51: On October 1, 2021, Eagle Company forecasts

Q52: Williams, Inc., a U.S. company, has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents