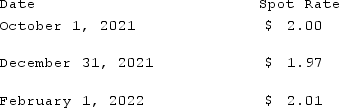

On October 1, 2021, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2022, at a price of 100,000 British pounds. On October 1, 2021, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2021, the option has a fair value of $1,600. The following spot exchange rates apply:  What journal entry should Eagle prepare on December 31, 2021?

What journal entry should Eagle prepare on December 31, 2021?

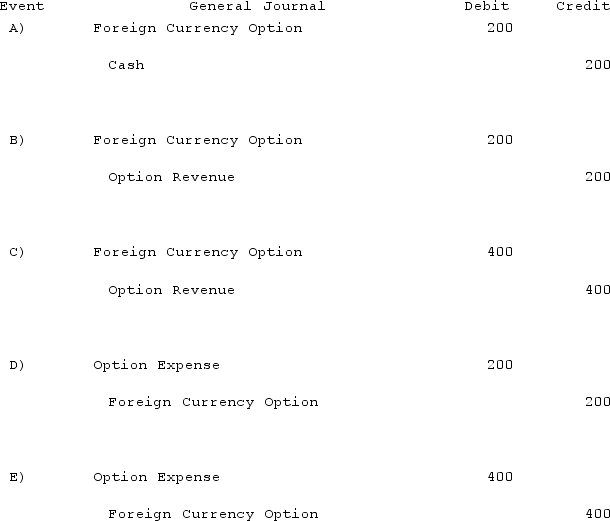

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Correct Answer:

Verified

Q71: What happens when a U.S. company purchases

Q72: All of the following data points are

Q73: On October 1, 2021, Eagle Company forecasts

Q74: What happens when a U.S. company sells

Q75: What is meant by the terms direct

Q77: For speculative derivatives, the change in the

Q78: To account for a forward contract cash

Q79: How does a foreign currency forward contract

Q80: What factors create a foreign exchange gain?

Q81: Coyote Corp. (a U.S. company in Texas)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents