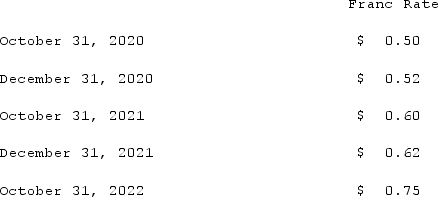

On October 31, 2020, Darling Company negotiated a two-year 100,000-franc loan from a foreign bank at an interest rate of 3% per year. Interest payments are made annually on October 31, and the principal will be repaid on October 31, 2022. Darling prepares U.S.-dollar financial statements and has a December 31 year-end. Prepare all journal entries related to this foreign currency borrowing assuming the following:

Correct Answer:

Verified

Q80: What factors create a foreign exchange gain?

Q81: Coyote Corp. (a U.S. company in Texas)

Q82: On December 1, 2021, King Co. sold

Q83: On October 1, 2021, Jarvis Co. sold

Q84: Old Colonial Corp. (a U.S. company) made

Q86: Potter Corp. (a U.S. company in Colorado)

Q87: Coyote Corp. (a U.S. company in Texas)

Q88: Coyote Corp. (a U.S. company in Texas)

Q89: Potter Corp. (a U.S. company in Colorado)

Q90: On December 1, 2021, King Co. sold

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents