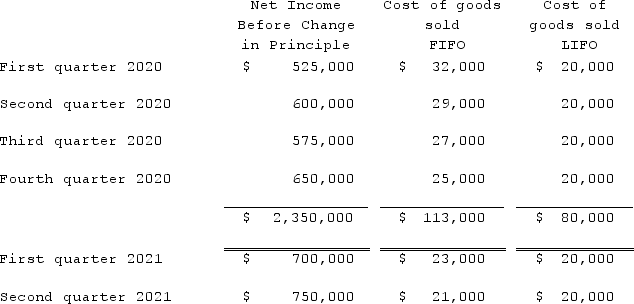

Harrison Company, Inc. began operations on January 1, 2020, and applied the LIFO method for inventory valuation. On June 10, 2021, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:  The LIFO method was applied during the first quarter of 2021 and the FIFO method was applied during the second quarter of 2021 in computing income, above. Harrison's effective income tax rate is 40%. Harrison has 500,000 shares of common stock outstanding at all times.Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2020 and 2021.

The LIFO method was applied during the first quarter of 2021 and the FIFO method was applied during the second quarter of 2021 in computing income, above. Harrison's effective income tax rate is 40%. Harrison has 500,000 shares of common stock outstanding at all times.Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2020 and 2021.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: Which two items of information must be

Q110: What related items need to be disclosed

Q111: Harrison Company, Inc. began operations on January

Q112: What is the purpose of the U.S.

Q113: The following information for Urbanski Corporation relates

Q115: List the five aggregation criteria that need

Q116: According to U.S. GAAP, how should general

Q117: What is meant by the term: disaggregated

Q118: For each of the following situations, select

Q119: What approach is used, according to U.S.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents