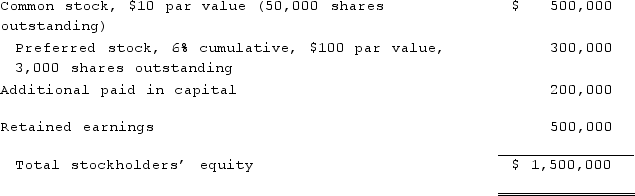

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Compute the noncontrolling interest in Smith at date of acquisition.

Compute the noncontrolling interest in Smith at date of acquisition.

A) $486,000.

B) $480,000.

C) $300,000.

D) $150,000.

E) $120,000.

Correct Answer:

Verified

Q22: On January 1, 2021, Nichols Company acquired

Q23: Davis Company has had bonds payable of

Q24: Which of the following statements is true

Q25: On January 1, 2021, Nichols Company acquired

Q26: If a subsidiary issues a stock dividend,

Q28: The following information has been taken from

Q29: A subsidiary issues new shares of common

Q30: Which of the following statements is false

Q31: Popper Co. acquired 80% of the common

Q32: In reporting consolidated earnings per share when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents