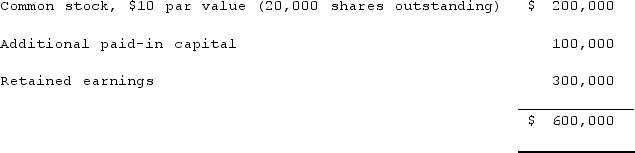

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago for $30 per share when Glotfelty had a book value of $450,000. Before and after that time, Glotfelty's stock traded at $30 per share. At the present time, Glotfelty reports the following stockholders' equity:  Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Fargus Corporation owned 51% of the voting

Q101: How are intra-entity inventory transfers treated on

Q102: Panton, Inc. acquired 18,000 shares of Glotfelty

Q103: Parent Corporation recently acquired some of its

Q104: Allen Co. held 80% of the common

Q106: Parent Corporation acquired some of its subsidiary's

Q107: During 2021, Parent Corporation purchased at carrying

Q108: What are the primary sources of information

Q109: Parent Corporation acquired some of its subsidiary's

Q110: Jet Corp. acquired all of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents