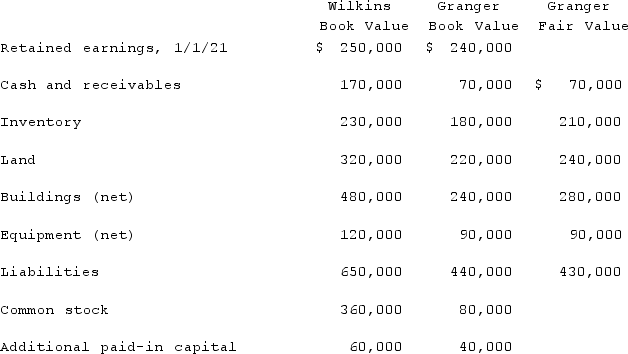

Wilkins Inc. acquired 100% of the voting common stock of Granger Inc. on January 1, 2021. The book value and fair value of Granger's accounts on that date (prior to creating the combination) are as follows, along with the book value of Wilkins's accounts:  Assume that Wilkins paid a total of $500,000 in cash for all of the shares of Granger. In addition, Wilkins paid $42,000 for secretarial and management time allocated to the acquisition transaction. What will be the balance in consolidated goodwill?

Assume that Wilkins paid a total of $500,000 in cash for all of the shares of Granger. In addition, Wilkins paid $42,000 for secretarial and management time allocated to the acquisition transaction. What will be the balance in consolidated goodwill?

A) $0.

B) $20,000.

C) $40,000.

D) $42,000.

E) $82,000.

Correct Answer:

Verified

Q14: What is the primary difference between: (i)

Q15: Which of the following examples accurately describes

Q16: Wilkins Inc. acquired 100% of the voting

Q17: In an acquisition where 100% control is

Q18: Acquired in-process research and development is considered

Q20: Prior to being united in a business

Q21: Which of the following statements is true

Q22: In a transaction accounted for using the

Q23: The financial statements for Campbell, Inc., and

Q24: The financial statements for Campbell, Inc., and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents