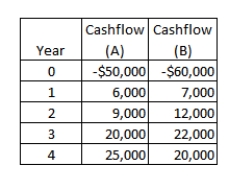

Quattro, Inc.has the following mutually exclusive projects available.The company has historically used a four-year cutoff for projects.The required return is 11 percent.  The payback for Project A is ____ while the payback for Project B is ____.The NPV for Project A is _____ while the NPV for Project B is ____.Which project, if any, should the company accept?

The payback for Project A is ____ while the payback for Project B is ____.The NPV for Project A is _____ while the NPV for Project B is ____.Which project, if any, should the company accept?

A) 2.782 years; 3.25 years; $ 7.090.12; $12,011.48; accept both Projects

B) 3.92 years; 3.79 years; -$6,197.89; $14,693.39; accept Project B only

C) 3.60 years; 3.95 years; -$6,197.89; -$14,693.39; reject both projects

D) 3.96 years; 3.42 years; $17,780.85; -$1,211.48; accept Project A only

E) 4.06 years; 3.79 years; $211.60; -$7,945.93; accept Project A only

Correct Answer:

Verified

Q97: You are considering the following two mutually

Q98: The Flour Baker is considering a project

Q99: You are considering an investment for which

Q100: The Steel Factory is considering a project

Q101: Miller and Sons is evaluating a project

Q103: What is the net present value of

Q104: Jefferson International is trying to choose between

Q105: A project has the following cash flows.What

Q106: Murphy's Authentic is considering a project with

Q107: Textiles Unlimited has gathered projected cash flows

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents