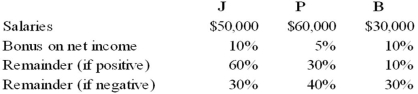

The JPB partnership reported net income of $160,000 for the year ended December 31, 20X8. According to the partnership agreement, partnership profits and losses are to be distributed as follows:  How should partnership net income for 20X8 be allocated to J, P, and B?

How should partnership net income for 20X8 be allocated to J, P, and B?

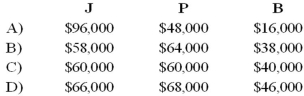

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q8: Which of the following accounts could be

Q9: A limited liability company (LLC):

I.is governed by

Q10: Note: This is a Kaplan CPA Review

Q10: The terms of a partnership agreement provide

Q11: Which of the following statements best describes

Q12: Which of the following statements best describes

Q14: Which of the following accounts is not

Q15: A partnership is a(n):

I.accounting entity.

II.taxable entity.

A)I only

B)II

Q16: The partnership of X and Y shares

Q17: Transferable interest of a partner includes all

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents