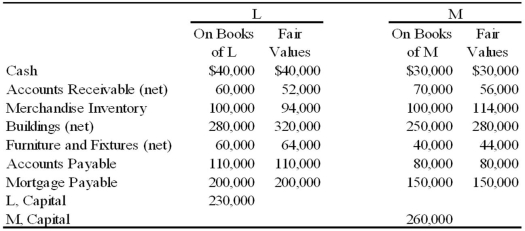

Two sole proprietors, L and M, agreed to form a partnership on January 1, 2009. The trial balance for each proprietorship is shown below as of January 1, 2009.

The LM partnership will take over the assets and assume the liabilities of the proprietors as of January 1, 2009.

Required:

a) Prepare a balance sheet, for financial accounting purposes, for the LM partnership as of January 1, 2009.

b) In addition, assume that M agreed to recognize the goodwill generated by L's business. Accordingly, M agreed to recognize an amount for L's goodwill such that L's capital equaled M's capital on January 1, 2009. Given this alternative, how does the balance sheet prepared for requirement A change?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: In the AD partnership, Allen's capital is

Q40: In the RST partnership, Ron's capital is

Q42: Net income for Levin-Tom partnership for 2009

Q43: The PQ partnership has the following plan

Q47: A partner's tax basis in a partnership

Q47: Note: This is a Kaplan CPA Review

Q49: Miller and Davis, partners in a consulting

Q65: In the JAW partnership,Jane's capital is $100,000,Anne's

Q67: Apple and Betty are planning on beginning

Q69: Paul and Ray sell musical instruments through

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents