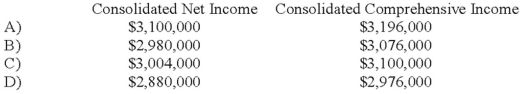

Seattle, Inc. owns an 80 percent interest in a Portuguese subsidiary. For 20X8, Seattle reported income from operations of $2.0 million. The Portuguese company's income from operations, after foreign currency translation, was $1.1 million. The foreign currency translation adjustment was $120,000 (credit) . Consolidated net income and consolidated comprehensive income for the year are:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q8: If the restatement method for a foreign

Q18: The balance in Newsprint Corp.'s foreign exchange

Q19: Note: This is a Kaplan CPA Review

Q20: Infinity Corporation acquired 80 percent of the

Q21: On January 2, 20X8, Johnson Company acquired

Q23: Which combination of accounts and exchange rates

Q24: For each of the items listed below,

Q25: The assets listed below of a foreign

Q26: On January 2, 20X8, Johnson Company acquired

Q27: On January 2, 20X8, Johnson Company acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents