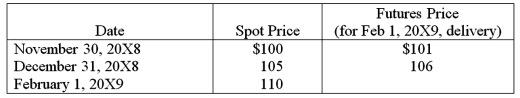

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:  The information for the change in the fair value of the options follows:

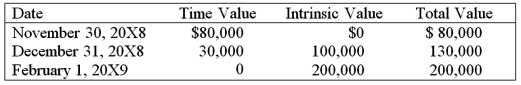

The information for the change in the fair value of the options follows:

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

Based on the preceding information, in the entry to record the increase in the intrinsic value of the options on December 31, 20X8,

A) Purchased Call Options will be credited for $100,000.

B) Purchased Call Options will be debited for $130,000.

C) Retained Earnings will be credited for $100,000.

D) Other Comprehensive Income will be credited for $100,000.

Correct Answer:

Verified

Q46: Spiralling crude oil prices prompted AMAR Company

Q47: The fair market value of a near-month

Q48: All of the following are management tools

Q49: On December 1, 20X8, Secure Company bought

Q50: Which of the following observations is true

Q50: All of the following are true statements

Q52: On December 1, 20X8, Winston Corporation acquired

Q53: The fair market value of a near-month

Q54: On December 1, 20X8, Denizen Corporation entered

Q55: Spiralling crude oil prices prompted AMAR Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents