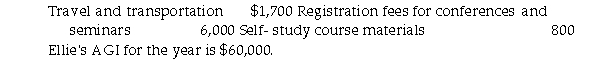

Ellie, a CPA, incurred the following deductible education expenses to maintain or improve her skills:  a. If Ellie is self- employed, what are the amount of and the nature of the deduction for these expenses?

a. If Ellie is self- employed, what are the amount of and the nature of the deduction for these expenses?

b. If, instead, Ellie is an employee who is not reimbursed by her employer, what are the amount of and the nat the deduction for these expenses (after limitations)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: A sole proprietor will not be allowed

Q42: In-home office expenses which are not deductible

Q46: All of the following may deduct education

Q48: Charles is a self- employed CPA who

Q50: Fiona is about to graduate college with

Q52: Alex is a self- employed dentist who

Q53: Pat is a sales representative for a

Q54: The following individuals maintained offices in their

Q55: Louisa, an active duty U.S. Air Force

Q56: Gina is an instructor at State University

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents