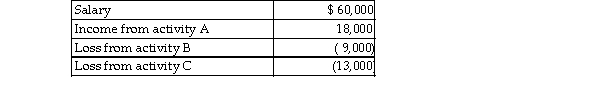

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attrib activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable ga What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attrib activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable ga What is Nancy's AGI as a result of these transactions?

A) $71,000

B) $55,000

C) $64,000

D) $50,000

Correct Answer:

Verified

Q21: Individuals who actively participate in the management

Q38: For purposes of applying the passive loss

Q169: Charlie owns activity B which was considered

Q170: Justin has AGI of $110,000 before considering

Q171: Lewis died during the current year. Lewis

Q172: A taxpayer's rental activities will be considered

Q175: An individual is considered to materially participate

Q176: Joseph has AGI of $170,000 before considering

Q177: Myriah earns salary of $80,000 and $20,000

Q178: Jana reports the following income and loss:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents