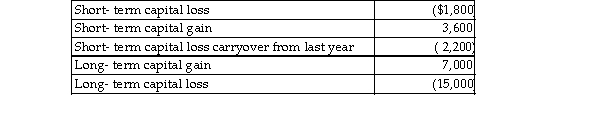

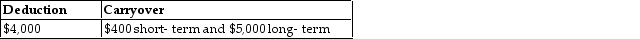

During the current year, Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year, and what is the amount and character of he loss carryover?

What is the amount of her capital loss deduction for the current year, and what is the amount and character of he loss carryover?

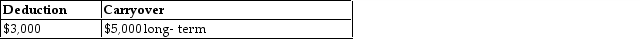

A)

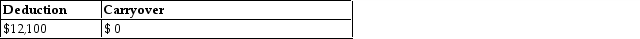

B)

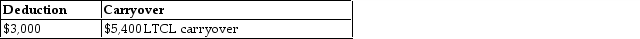

C)

D)

Correct Answer:

Verified

Q105: Gain on sale of a patent by

Q110: Corporate taxpayers may offset capital losses only

Q118: Abra Corporation generated $100,000 of taxable income

Q614: Chen had the following capital asset transactions

Q615: Maya expects to report about $2 million

Q616: Olivia, a single taxpayer, has AGI of

Q620: Max sold the following capital assets this

Q622: On January 31 of the current year,

Q623: How long must a capital asset be

Q624: On July 25, 2017, Marilyn gives stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents