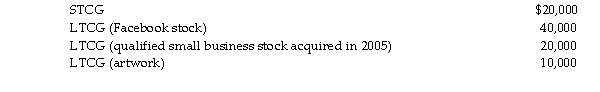

Tina, whose marginal tax rate is 32%, has the following capital gains this year:  What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

Correct Answer:

Verified

Q66: Generally,gains resulting from the sale of collectibles

Q73: Net long-term capital gains receive preferential tax

Q106: Unlike an individual taxpayer,the corporate taxpayer does

Q599: Antonio is single and has taxable income

Q600: To be considered a Section 1202 gain,

Q601: Andrea died with an unused capital loss

Q603: Stella has two transactions involving the sale

Q604: Gertie has a NSTCL of $9,000 and

Q605: Candice owns a mutual fund that reinvests

Q607: Jade is a single taxpayer in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents