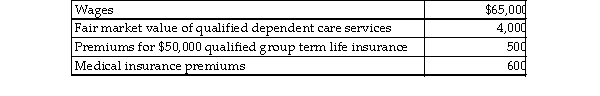

Carl filed his tax return, properly claiming the head of household filing status. Carl's employer paid or provided following to Carl:  How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

A) $70,100

B) $65,000

C) $69,000

D) $69,500

Correct Answer:

Verified

Q717: Bret carries a $200,000 insurance policy on

Q718: Tonya's employer pays the full premium on

Q719: Linda was injured in an automobile accident

Q720: Miranda is not a key employee of

Q721: Ahmad's employer pays $10,000 in tuition this

Q723: Jan has been assigned to the Rome

Q724: Melanie, a U.S. citizen living in Paris,

Q725: For a taxpayer who is not insolvent

Q726: Benefits covered by Section 132 which may

Q727: Heather is an advertising executive with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents