On April 5, 2018, Joan contributes business equipment (she had purchased on October 24, 2015) having a $45,000 FMV and a $40,000 adjusted basis to the EJK Partnership in exchange for a 25% interest in the capital and profits. The basis of the property and the date the holding period begins for the partnership is

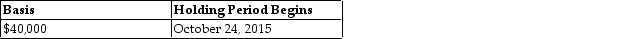

A)

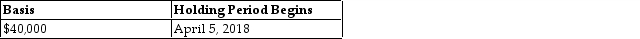

B)

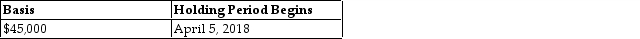

C)

D)

Correct Answer:

Verified

Q87: Joy is a material participant in a

Q1174: Chen contributes a building worth $160,000 (adjusted

Q1175: George transferred land having a $170,000 FMV

Q1176: Kuda exchanges property with a FMV of

Q1177: Martha transferred property with a FMV of

Q1178: Patrick acquired a 50% interest in a

Q1180: Ezinne transfers land with an adjusted basis

Q1181: A taxpayer has various businesses which operate

Q1182: Sandy and Larry each have a 50%

Q1183: Richard has a 50% interest in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents