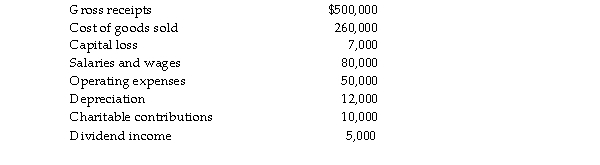

Sycamore Corporation's financial statements show the following items for the current year in its financial accoun records:  For tax purposes, depreciation is $22,000. Sycamore owns less than 20% of the company from which it received dividends. Calculate Sycamore's taxable income, tax liability, and carryforwards.

For tax purposes, depreciation is $22,000. Sycamore owns less than 20% of the company from which it received dividends. Calculate Sycamore's taxable income, tax liability, and carryforwards.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q69: In a Sec.351 transfer,the corporation takes the

Q71: In order for the Sec.351 nonrecognition rules

Q75: The term "thin capitalization" means that the

Q76: Depreciation recapture does not apply to a

Q1343: Individuals Gayle and Marcus form GM Corporation.

Q1344: Individuals Rhett and Scarlet form Lady Corporation.

Q1345: Individuals Terry and Jim form TJ Corporation.

Q1349: Individuals Opal and Ben form OB Corporation.

Q1352: Individuals Julie and Brandon form JB Corporation.

Q1353: Which of the statements is inaccurate regarding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents