Ten years ago Finn Corporation formed a new 100 percent owned subsidiary, Wing Corporation, with a $500,000 investment. Wing Corporation is completely liquidated this year, with all assets distributed to Finn Corporation. As of the liquidation date, Wing has a basis in its assets of $350,000, and the assets are valued at

$550,000. What is the gain or loss recognized by Finn Corporation due to the liquidating distribution, and what is Finn Corporation's basis in the assets received from Wing Corporation?

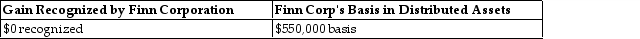

A)

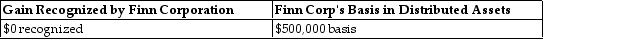

B)

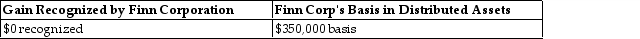

C)

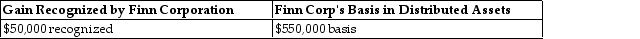

D)

Correct Answer:

Verified

Q96: A corporation redeems 10 percent of the

Q108: How does the treatment of a liquidation

Q1376: A corporation earns $500,000 of current E&P

Q1377: Bob transfers assets with a $100,000 FMV

Q1378: Atlantic Corporation, a calendar- year taxpayer, has

Q1379: John transfers assets with a $200,000 FMV

Q1380: Danielle transfers land with a $100,000 FMV

Q1383: Whaler Corporation makes a liquidating distribution of

Q1385: A liquidating corporation

A) never recognizes gains and

Q1386: A corporation distributes land with a FMV

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents