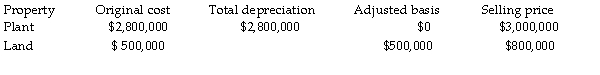

Julie sells her manufacturing plant and land originally purchased in 1980. Accelerated depreciation had been tak building, but the building is now fully depreciated. Julie is in the 37% marginal tax bracket. Other information is follows:  She has not sold any other assets this year. A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year. What are the tax consequences of the sale (type of gain; rates at which taxed)?

She has not sold any other assets this year. A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year. What are the tax consequences of the sale (type of gain; rates at which taxed)?

Correct Answer:

Verified

Q63: In addition to the normal recapture rules

Q65: When appreciated property is transferred at death,the

Q68: When a donee disposes of appreciated gift

Q70: Frisco Inc.,a C corporation,placed a building in

Q80: The additional recapture under Sec.291 is 25%

Q83: Installment sales of depreciable property which result

Q93: If no gain is recognized in a

Q1746: Describe the tax treatment for a noncorporate

Q1747: A corporation sold a warehouse during the

Q1748: WAM Corporation sold a warehouse during the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents