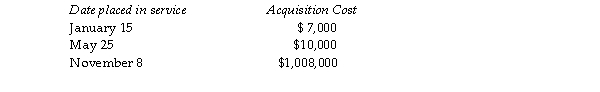

Greta, a calendar- year taxpayer, acquires 5- year tangible personal property in 2018 and places the property in service on the following schedule:  Greta elects to expense the maximum under Sec. 179, and selects the property placed into service on November 8 property is not eligible for bonus depreciation. Her business's taxable income before Sec. 179 is $790,000. What is total cost recovery deduction (depreciation and Sec. 179) for 2018?

Greta elects to expense the maximum under Sec. 179, and selects the property placed into service on November 8 property is not eligible for bonus depreciation. Her business's taxable income before Sec. 179 is $790,000. What is total cost recovery deduction (depreciation and Sec. 179) for 2018?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: Amounts paid in connection with the acquisition

Q71: Most taxpayers elect to expense R&E expenditures

Q2094: Jack purchases land which he plans on

Q2095: During the year 2018, a calendar- year

Q2096: Arthur uses a Chevrolet Suburban (GVWR 7,500

Q2097: Everest Corp. acquires a machine (seven- year

Q2098: In February 2018, Pietra acquired a new

Q2100: In the current year George, a college

Q2102: Galaxy Corporation purchases specialty software from a

Q2103: In calculating depletion of natural resources each

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents