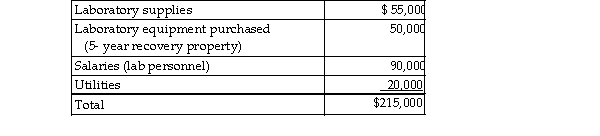

This year Bauer Corporation incurs the following costs in development of new products:  No benefits are realized from the research expenditures until next year. The corporation does not claim Sec. 179 or bonus depreciation on any of its assets. If Bauer Corporation elects to expense the research expenditures, the deduction is

No benefits are realized from the research expenditures until next year. The corporation does not claim Sec. 179 or bonus depreciation on any of its assets. If Bauer Corporation elects to expense the research expenditures, the deduction is

A) $10,000 this year and $175,000 next year.

B) $215,000 this year.

C) $175,000 this year.

D) $175,000 next year.

Correct Answer:

Verified

Q67: Unless an election is made to expense

Q69: Taxpayers are entitled to a depletion deduction

Q79: If a company acquires goodwill in connection

Q83: Intangible drilling and development costs (IDCs)may be

Q2106: On January 1, 2018, Charlie Corporation acquires

Q2107: On January 1 of the current year,

Q2108: Under what circumstances might a taxpayer elect

Q2113: Bert, a self- employed attorney, is considering

Q2114: Costs that qualify as research and experimental

Q2115: Stellar Corporation purchased all of the assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents