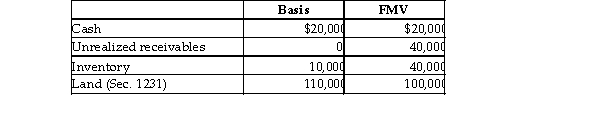

Kenya sells her 20% partnership interest having a $28,000 basis to Ebony for $40,000 cash. At the tim the sale, the partnership has no liabilities and its assets are as follows:  Kenya and Ebony have no agreement concerning the allocation of the sales price. Ordinary income recognized by Kenya as a result of the sale is

Kenya and Ebony have no agreement concerning the allocation of the sales price. Ordinary income recognized by Kenya as a result of the sale is

A) $12,000.

B) $16,000.

C) $6,000.

D) $14,000.

Correct Answer:

Verified

Q32: Last year, Cara contributed investment land with

Q39: The definition of "inventory" for purposes of

Q40: The Tandy Partnership owns the following assets

Q41: Identify which of the following statements is

Q46: The sale of a partnership interest always

Q46: Identify which of the following statements is

Q49: Ten years ago, Latesha acquired a one-

Q50: Identify which of the following statements is

Q55: Derrick's interest in the DEF Partnership is

Q74: Eicho's interest in the DPQ Partnership is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents