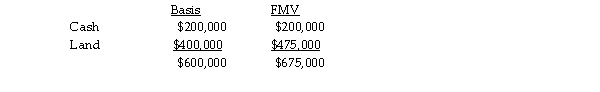

Sean, Penelope, and Juan formed the SPJ partnership by each contributing assets with a basis and fair market value of $200,000. In the following year, Penelope sold her one- third interest to Pedro for $225,000. At the time o the sale, the SPJ partnership had the following balance sheet:  Shortly after Pedro became a partner, SPJ sold the land for $475,000. What are the tax consequences of the sale to and the partnership (1) assuming there is no Section 754 election in place, and (2) assuming the partnership has a Section 754 election?

Shortly after Pedro became a partner, SPJ sold the land for $475,000. What are the tax consequences of the sale to and the partnership (1) assuming there is no Section 754 election in place, and (2) assuming the partnership has a Section 754 election?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Identify which of the following statements is

Q76: Sally is a calendar- year taxpayer who

Q81: A limited liability company is a form

Q82: Han purchases a 25% interest in the

Q87: What are some advantages and disadvantages of

Q92: Quinn and Pamela are equal partners in

Q92: Which of the following is a valid

Q95: Identify which of the following statements is

Q106: The limited liability company (LLC)has become a

Q108: The Principle Limited Partnership has more than

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents