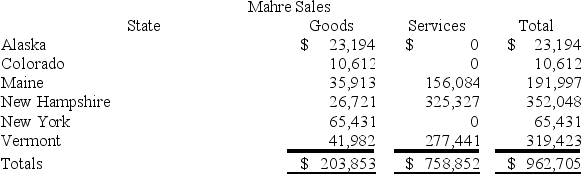

Mahre,Incorporated,a New York corporation,runs ski tours in a several states.Mahre also has a New York retail store and an Internet store,which ships to out-of-state customers.Assume sales transactions in all states,except New York,are under 200 and that all states have adopted Wayfair legislation.The ski tours operate in Maine,New Hampshire,and Vermont,where Mahre has employees and owns and uses tangible personal property.Mahre has real property only in New York.Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent) ,Colorado (7.75 percent) ,Maine (8.5 percent) ,New Hampshire (0 percent) ,New York (8 percent) ,and Vermont (5 percent) .How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent) ,Colorado (7.75 percent) ,Maine (8.5 percent) ,New Hampshire (0 percent) ,New York (8 percent) ,and Vermont (5 percent) .How much sales and use tax must Mahre collect and remit?

A) $10,386

B) $14,543

C) $26,733

D) $61,289

Correct Answer:

Verified

Q44: All of the following are false regarding

Q46: Which of the following is true regarding

Q47: Which of the following law types is

Q50: Which of the following sales is always

Q64: On which of the following transactions should

Q72: Bethesda Corporation is unprotected from income tax

Q72: Which of the following is not one

Q74: Roxy operates a dress shop in Arlington,

Q75: Public Law 86-272 protects a taxpayer from

Q95: Which of the following isn't a typical

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents