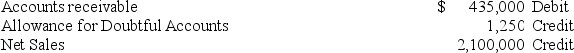

The unadjusted trial balance at year-end for a company that uses the percent of receivables method to determine its bad debts expense reports the following selected amounts:  All sales are made on credit.Based on past experience,the company estimates 3.5% of ending account receivable to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 3.5% of ending account receivable to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A) Debit Bad Debts Expense $13,975; credit Allowance for Doubtful Accounts $13,975.

B) Debit Bad Debts Expense $15,225; credit Allowance for Doubtful Accounts $15,225.

C) Debit Bad Debts Expense $16,475; credit Allowance for Doubtful Accounts $16,475.

D) Debit Bad Debts Expense $7,350; credit Allowance for Doubtful Accounts $7,350.

E) Debit Bad Debts Expense $17,350; credit Allowance for Doubtful Accounts $17,350.

Correct Answer:

Verified

Q61: On February 1,a customer's account balance of

Q62: MacKenzie Company sold $300 of merchandise to

Q69: Winkler Company borrows $85,000 and pledges its

Q71: Frederick Company borrows $63,000 from First City

Q73: Mullis Company sold merchandise on account to

Q74: Under IFRS,the term provision:

A)Refers to expense.

B)Usually refers

Q142: MacKenzie Company sold $180 of merchandise to

Q148: On November 19,Nicholson Company receives a $15,000,60-day,8%

Q149: On July 9,Mifflin Company receives an $8,500,90-day,8%

Q151: All of the following statements regarding recognition

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents