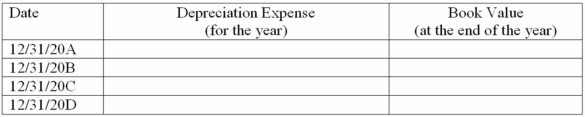

On January 1, 20A, Stern Company (a calendar year corporation) purchased a heavy duty machine having an invoice price of $13,000 plus transportation and installation costs of $3,000. The machine is estimated to have a 4-year useful life and a $1,000 residual value. Assuming the company uses the declining-balance method depreciation and a 150% acceleration rate, complete the following schedule (round to the nearest dollar).

Correct Answer:

Verified

Declin...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: An item of property, plant, and equipment

Q25: If the proceeds from the sale of

Q101: When an operational asset is acquired for

Q131: Raco Inc. purchased two used machines together

Q132: The fixed asset turnover ratio measures how

Q133: On January 1, 20A, Reagan Company purchased

Q134: Macon Assembly Company purchased a machine on

Q136: If an accountant calculates depreciation expense on

Q141: Here are selected 2013 transactions of Avery

Q152: The cost principle should be applied in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents