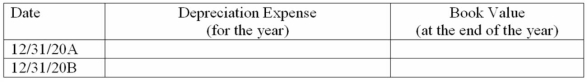

Sutter Company purchased a machine on January 1, 20A, for $16,000. The machine has an estimated useful life of 5 years and a $1,000 residual value. It is now December 31, 20B, and Sutter is in the process of preparing financial statements. Complete the following schedule assuming declining-balance method of depreciation with a 150% acceleration rate.

Correct Answer:

Verified

Q147: Pied Piper Pies has been in business

Q148: The following information is available for C

Q149: Tweed Feed & Seed purchased a new

Q150: Hilman Company purchased a truck on January

Q151: Yell Company made a lump sum purchase

Q152: On September 7, 20B, Belverd Corporation purchased

Q154: On January 2, 20D, Daintry Company purchased

Q155: Duval Company acquired a machine on January

Q156: Weaver Mining Company purchased a site containing

Q157: Chamber Company purchased a truck on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents