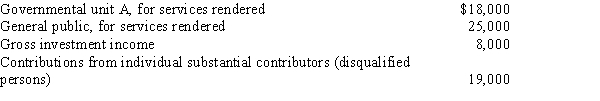

Blue, Inc., receives its support from the following sources.  Which of the following statements is correct?

Which of the following statements is correct?

A) Blue, Inc., is a private foundation because it satisfies the external support test and fails the internal support test.

B) Blue, Inc., is not a private foundation because it fails both the internal and external support tests.

C) Blue, Inc., is a private foundation because it satisfies both the external support test and the internal support test.

D) Blue, Inc., is not a private foundation because it satisfies both the external support test and the internal support test.

E) None of the statements is true.

Correct Answer:

Verified

Q21: Only certain exempt organizations must obtain IRS

Q28: The due date for the Exempt Organization

Q44: Unless the "widely available" provision is satisfied,

Q48: Third Church operates a gift shop in

Q50: All exempt organizations which are subject to

Q53: A § 501(c)(3) organization that otherwise would

Q54: Garden, Inc., a qualifying § 501(c)(3) organization,

Q56: Which of the following attributes are associated

Q79: Tan, Inc., a tax-exempt organization, has $65,000

Q95: For purposes of the unrelated business income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents