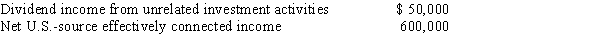

BrazilCo, Inc., a foreign corporation with a U.S. trade or business, has U.S.-source income as follows.

Determine BrazilCo's total U.S. tax liability for the year, assuming a 35% corporate rate and no tax treaty. BrazilCo leaves its U.S. branch profits invested in the United States, and it does not otherwise repatriate any of its U.S. assets during the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Which of the following statements regarding the

Q90: Match the definition with the correct term.

-Bilateral

Q95: Which of the following statements is true,

Q109: Match the definition with the correct term.

-Foreign

Q116: Which of the following statements best describes

Q116: USCo,a U.S.corporation,receives $700,000 of foreign-source passive income

Q130: KeenCo,a U.S.corporation,is the sole shareholder of LovettCo,a

Q130: Given the following information, determine if FanCo,

Q135: Present,Inc.,a U.S.corporation,owns 60% of the stock of

Q139: Given the following information, determine whether Greta,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents