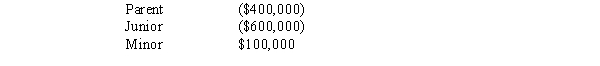

The Maestro consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Parent.

A) $360,000.

B) $400,000.

C) $500,000.

D) $900,000. All NOLs of a consolidated group are apportioned to the parent.

Correct Answer:

Verified

Q33: When a member departs from a consolidated

Q47: The Rack, Spill, and Ton Corporations file

Q52: Which of the following is not generally

Q60: Which of the following potentially is a

Q61: ParentCo purchased 100% of SubCo's stock on

Q63: ParentCo and SubCo had the following items

Q64: Calendar year ParentCo acquired all of the

Q65: The Nanie consolidated group reported the following

Q66: ParentCo and SubOne have filed consolidated returns

Q68: The consolidated net operating loss of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents