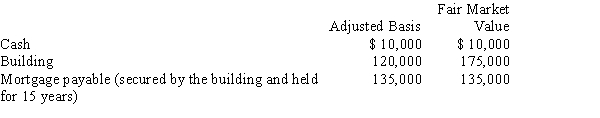

Dick, a cash basis taxpayer, incorporates his sole proprietorship. He transfers the following items to newly created Orange Corporation.

With respect to this transaction:

A) Orange Corporation's basis in the building is $120,000.

B) Dick has no recognized gain.

C) Dick has a recognized gain of $5,000.

D) Dick has a recognized gain of $10,000.

E) None of the above.

Correct Answer:

Verified

Q52: Jane transfers property (basis of $180,000 and

Q53: Ira,a calendar year taxpayer,purchases as an investment

Q55: Kevin and Nicole form Indigo Corporation with

Q56: Rob and Fran form Bluebird Corporation with

Q63: Dawn, a sole proprietor, was engaged in

Q67: Wade and Paul form Swan Corporation with

Q74: Leah transfers equipment (basis of $400,000 and

Q80: Rachel owns 100% of the stock of

Q91: Rita forms Finch Corporation by transferring land

Q109: Karen formed Grebe Corporation with an investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents