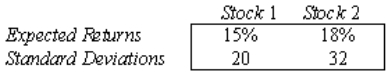

An analysis of the stock market produces the following information about the returns of two stocks:  Assume that the returns are positively correlated, with

Assume that the returns are positively correlated, with  12 = 0.80.

12 = 0.80.

a. Find the mean and standard deviation of the return on a portfolio consisting of an equal investment in each of the two stocks.

b. Suppose that you wish to invest $1 million. Discuss whether you should invest your money in stock 1, stock 2, or a portfolio composed of an equal amount of investments on both stocks.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A discrete random variable can take either

Q29: For each of the following random variables,

Q31: An official from the Australian Securities and

Q37: Let X and Y be two

Q40: State whether or not each of

Q43: Let X be a binomial random variable

Q44: Let X be a Poisson random

Q47: Let X be a Poisson random

Q49: A market researcher selects 20 students at

Q50: The proprietor of a small hardware store

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents