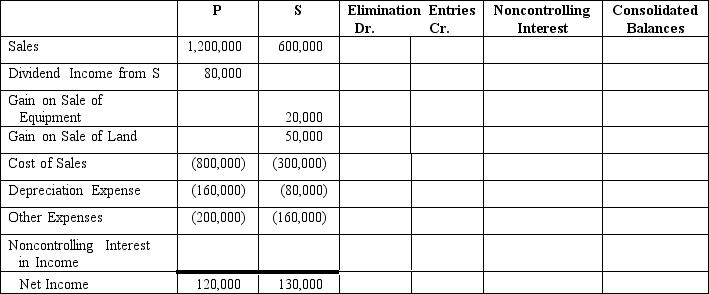

P Corporation acquired 80% of the outstanding voting stock of S Corporation when the fair values equaled the book values.

On July 1, 2013, P sold land to S for $300,000.The land originally cost P $200,000.S recently resold the land on October 30, 2014 for $350,000.

On October 1, 2014, S Corporation sold equipment to P Corporation for $80,000.S originally paid $100,000 for this equipment and had accumulated depreciation of $40,000 thus far.The equipment has a five-year remaining life.

Required:

A.Complete the consolidated income statement for P Corporation and subsidiary for the year ended December 31, 2014.

Correct Answer:

Verified

Q32: Pine Company, a computer manufacturer, owns 90%

Q33: On January 1, 2013, Pound Company acquired

Q34: What is the essential procedural difference between

Q35: On January 1, 2014, Pharma Company purchased

Q36: On January 1, 2013, P Corporation sold

Q37: In what period and in what manner

Q39: An eliminating entry is needed to adjust

Q40: Define consolidated retained earnings using the analytical

Q41: Should the CEO or CFO be a

Q42: Should the firm's audit committee be composed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents