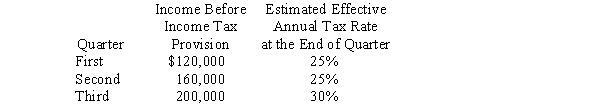

Bjork, a calendar year company, has the following income before income tax provision and estimated effective annual income tax rates for the first three quarters of 2014:  Bjork's income tax provision in its interim income statement for the third quarter should be

Bjork's income tax provision in its interim income statement for the third quarter should be

A) $74,000.

B) $60,000.

C) $50,000.

D) $144,000.

Correct Answer:

Verified

Q22: In SFAS No. 131, the FASB requires

Q26: In January 2014, Cain Company paid $200,000

Q28: Which of the following statements most accurately

Q28: XYZ Corporation has eight industry segments with

Q29: Advertising costs may be accrued or deferred

Q30: If annual major repairs made in the

Q32: Walleye Industries operates in four different industries.Information

Q33: The computation of a company's third quarter

Q36: When a company issues interim financial statements,

Q36: Blink Company, which uses the FIFO inventory

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents