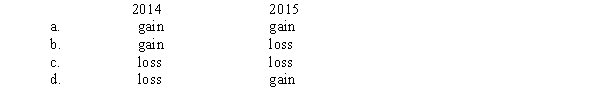

During 2014, a U.S.company purchased inventory from a foreign supplier.The transaction was denominated in the local currency of the seller.The direct exchange rate increased from the date of the transaction to the balance sheet date.The exchange rate decreased from the balance sheet date to the settlement date in 2015.For the years 2014 and 2015, transaction gains or losses should be recognized as:

Correct Answer:

Verified

Q1: The forward exchange rate quoted for the

Q4: Madison Paving Company purchased equipment for 350,000

Q5: A transaction gain or loss at the

Q6: The discount or premium on a forward

Q8: From the viewpoint of a U.S. company,

Q10: On November 1, 2014, American Company sold

Q12: A transaction gain or loss is reported

Q16: An indirect exchange rate quotation is one

Q19: Montana Corporation a U.S. company, contracted to

Q20: A transaction gain is recorded when there

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents