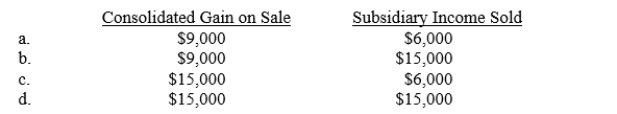

P Corporation purchased an 80% interest in S Corporation on January 1, 2013, at book value for $300,000.S's net income for 2013 was $90,000 and no dividends were declared.On May 1, 2013, P reduced its interest in S by selling a 20% interest, or one-fourth of its investment for $90,000.What will be the Consolidated Gain on Sale and Subsidiary Income Sold for 2013?

Correct Answer:

Verified

Q1: Use the following information for Questions 19-21.

On

Q2: Parr Company owned 24,000 of the 30,000

Q4: Which one of the following statements regarding

Q5: Parr Company owned 24,000 of the

Q7: Use the following information for Questions 19-21.

On

Q8: On January 1, 2009, Panda Company purchased

Q10: If a subsidiary issues new shares of

Q10: On January 1, 2013, P Corporation purchased

Q11: Use the following information for Questions 19-21.

On

Q13: The purchase by a subsidiary of some

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents